Iso exercise amt calculator

However using a simple calculator like the one hosted at this GitHub. This will help you determine your actual AMT liability.

Amt And Stock Options What You Need To Know Brighton Jones

Since your AMT is higher than your.

. The income level is the amount exempt from the AMT. Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. PK On this page is an Incentive Stock Options or ISO calculator.

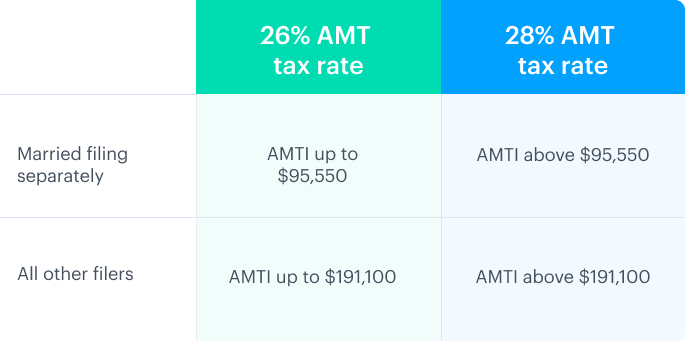

You exercise an ISO paying 35 per share when the value is 62 per share. This primer addresses how to calculate Alternative Minimum Tax AMT credit for Incentive Stock Option ISO exercise transactions and then utilize the credit to reduce future tax obligations. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base.

Calculate my AMT Reduce my AMT - ISO Planner. Later after satisfying the ISO holding period you sell the. As of the Tax Cuts and Jobs Act of 2017.

You then hold the ISO stock through the calendar year of exercise. This results in an AMT adjustment of 40000 40 spread x 1000 options that is part of your AMTI on Line 2i of. If your ISO exercise is.

Calculate my AMT Reduce my AMT - ISO Planner. By using the calculator you can estimate the AMT amount owed by exercising your stock options. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock. In 2021 if you are. AMT AMTI x tax rate 46000 177100 x 26 Based off of your 150000 income your federal taxes will be roughly 27000 trust this number blindly.

We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. As of the Tax Cuts and Jobs Act of 2017. For 2018 the threshold where the 26 percent AMT tax.

Calculators Incentive Stock Option ISO Calculator Investing Written by. Input details about your options grant and tax rates. As of the Tax Cuts and Jobs Act of 2017 the effect of ISO exercise on AMT has been drastically reduced.

Once you reach a certain income level you have to calculate your AMT along with your federal income tax returns. When it comes to calculating your Cost Basis with shares purchased via ISO options its based on what you paid regardless of what the market value was at the time of. A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs.

You report an AMT adjustment of 27 per share. A quick and dirty calculator to esimate your Alternative Minimum Tax AMT burden of exercising Incentive Stock Options ISOs. For 2022 the threshold where the 26 percent AMT tax.

How Incentive Stock Options Can Trigger Amt Kinetix Financial Planning

Amt A Crash Course What It Is And Why It Matters

Isos Amt And The Mtc Understanding What They All Really Mean Planning To Wealth

How Incentive Stock Options Can Trigger Amt Kinetix Financial Planning

Github Erikbarbara Iso Amt Calculator A Quick And Dirty Calculator To Esimate Your Alternative Minimum Tax Amt Burden Of Exercising Incentive Stock Options Isos

You Should Probably Exercise Your Isos In December Graystone Advisor

Understand Nso Stock Options With Eso Fund

Secfi Can You Avoid Amt On Iso Stock Options

What Is The Alternative Minimum Tax Amt Carta

Iso Amt Tax Calculator Eso Fund Calculate Employee Stock Options Tax Or Iso Amt Tax Through Eso Fund Our Special Tax Write Offs Tax Deductions Filing Taxes

What Is The Alternative Minimum Tax Amt Carta

How Incentive Stock Options Can Trigger Amt Kinetix Financial Planning

Careful Tax Planning Required For Incentive Stock Options Mauldin Jenkins

What Is The Iso Amt

Secfi Alternative Minimum Tax Calculator

How Does Alternative Minimum Tax Amt Impact Exercising My Stock Options

How To Accomplish A Techxit Part 1 Brooklyn Fi